Like everybody else I use plastic for most purchases. My debit card and I are as one. Periodically the bank sends us a short novel based on our transactions: the story of our month in the form of expenditures.

Last week, my debit card’s chip died. Card readers in retail stores would still let me swipe the card — but only after I’d tried the chip three times, and failed. That didn’t work for me. I called the bank, and they sent a new chip card my way. ETA, a few days.

But the card worked fine in the bank’s own ATMs. I could withdraw money. And so I rediscovered the World of Cash. It is a wondrous place. There are dangers, but the advantages are huge.

Cash is a great timesaver. I just… hand it to the clerk. I don’t have to insert a card into a slot, wait for a prompt on a machine, punch in a code or any of those things. The clerk makes change, gives it to me, and hands me a receipt. That’s it.

Yes, there are phone apps for all this. Just pony up a grand for your iPhone, plus the monthly charges, and you’re all set.

In the meantime, I have now have time to make actual eye contact with the clerk serving me. I can relate to them as human beings, instead of doing data entry work on a tiny keyboard. Work, by the way, that I don’t get paid for.

My private life stays more private. Cash is independent of any database. Nobody knows what I spent my money on, or even that I spent any at all. There’s no record.

My transaction information or contact information cannot be stolen or sold. It will not be added to a database of all things known about me. It will not be sold to companies or entities public or private, foreign or domestic.

Cash will work when the Internet goes down. You think that the Internet will never go down? It did once where I live, for most of a day. All e-commerce, all credit and debit transactions, all ATMs: down for millions of people, thanks to a couple of guys with a little knowledge, a lot of attitude, and wire cutters. Commerce held together that day until repairs were made; but two days? Three? We didn’t find out. I don’t want to.

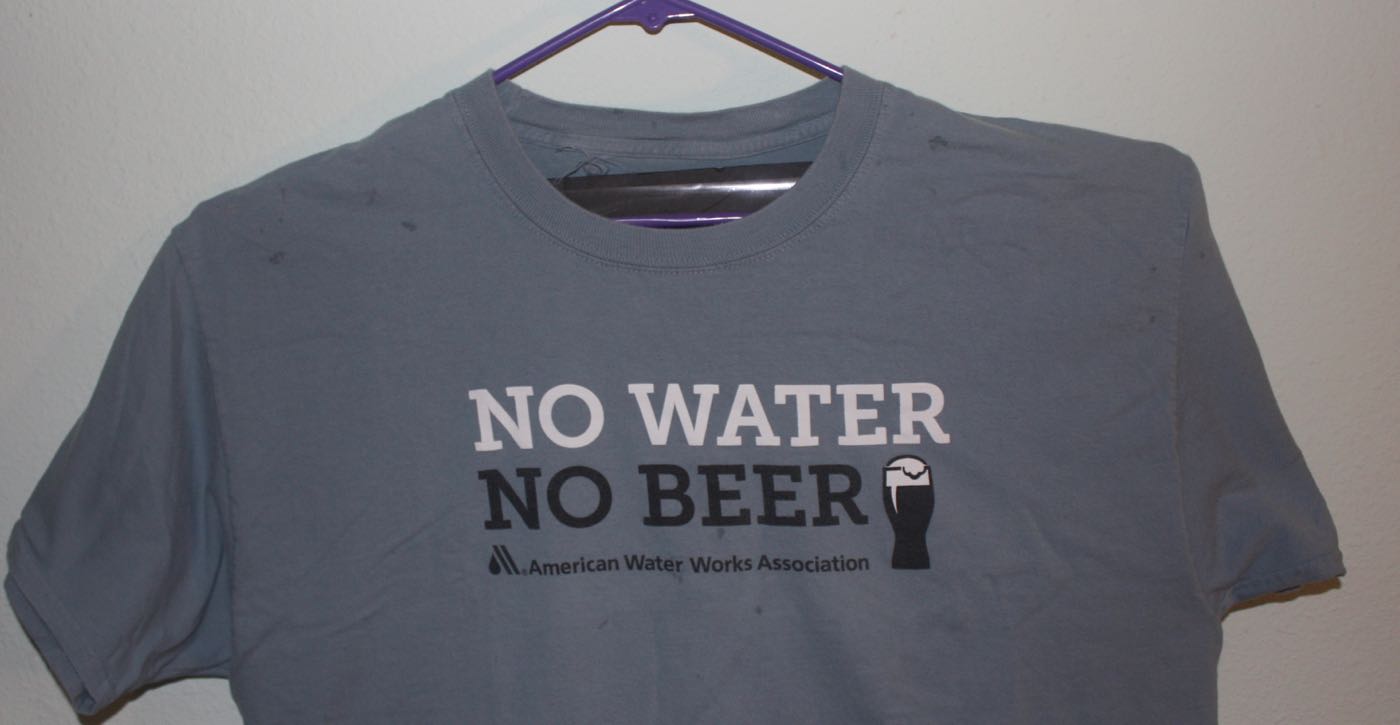

With cash, I also find that I spend less. When I purchase something with plastic, the plastic remains. When I purchase something with cash, I have less cash. As the amount of cash decreases, I reconsider impulse buys.

Cash is accepted nearly everywhere, with no service fee to customer or vendor. Some retailers want to go cashless; this is unacceptable. And it will remain unacceptable until everyone, no matter how poor, has a checking account and card. Over 8.4 million households in the United States are “unbanked.”

Sweden is moving a cashless society. Many stores and even banks no longer deal in cash. The Swede in the Street supports them, or most of them do. They have faith that their government will shape this trend to everyone’s best interest.

I used to feel that way about the United States government. If a politician had a (D) after their name, I felt that they were working for me. I no longer do: Sweden may take care of its people, but the people in power over us tend to blame the victims. “No card? Well, GET ONE!” Some pols with the (D) after their name tend to agree; or stay silent.

Cash can’t do everything. Some purchases are too large for cash — though I can carry checks. There is no question, though, that e-commerce is here to stay. My new chip card arrived yesterday from Omaha. And while it remains in its envelope for now, I will need it soon.

But not every day. Not for every single routine purchase of food and clothing and merchandise — all of which add up so quickly if you don’t watch the money physically dwindle.

There are counterfeit bills to deal with, of course. And cash can be stolen. On the other hand, an e-commerce purchase can easily provide you with counterfeit merchandise, that is inferior or even dangerous. And hackers sniff daily at you and your accounts, looking for weaknesses.

There is danger everywhere; just, different dangers and different ways of staying safe.

I’m sorry that the cash solution isn’t for everybody, because we live in a society where tens of millions — maybe over a hundred million, I don’t know — can’t obtain the necessities without credit cards and short-term debt.

I remember the time I ever saw the words “We take credit cards” in the window of a supermarket. This was 35 years ago, and buying food on credit was unheard of in my city. Everyone had always used cash to buy food. Everyone had enough cash. Or they had, up till then.

I thought to myself, something’s wrong. This is a dangerous road.

And it is. Now more than ever.